Forex

“Price Action, Support/Resistance (S/R) levels, and basic line analysis are crucial for developing a contextual understanding of trade and pinpointing areas of volatility surges.”

In this video I analyze GOLD chart showing using PitchFork, Support and Resistance lines and candlesticks reading.

The purpose of this video is to show that price action trading is a precise way of profitable trading provided you build context first before hitting the buy or sell button.

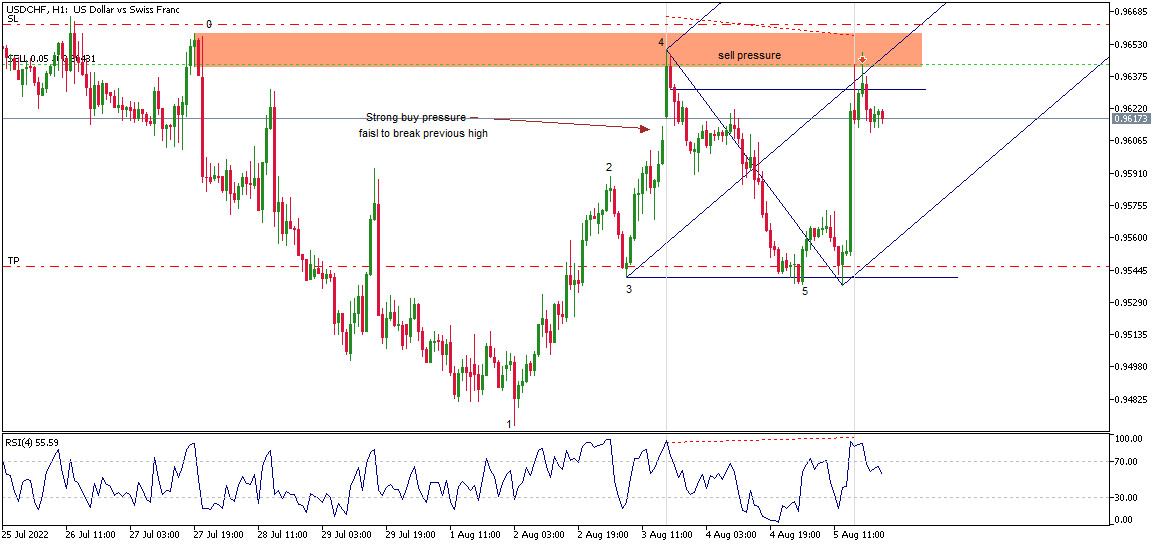

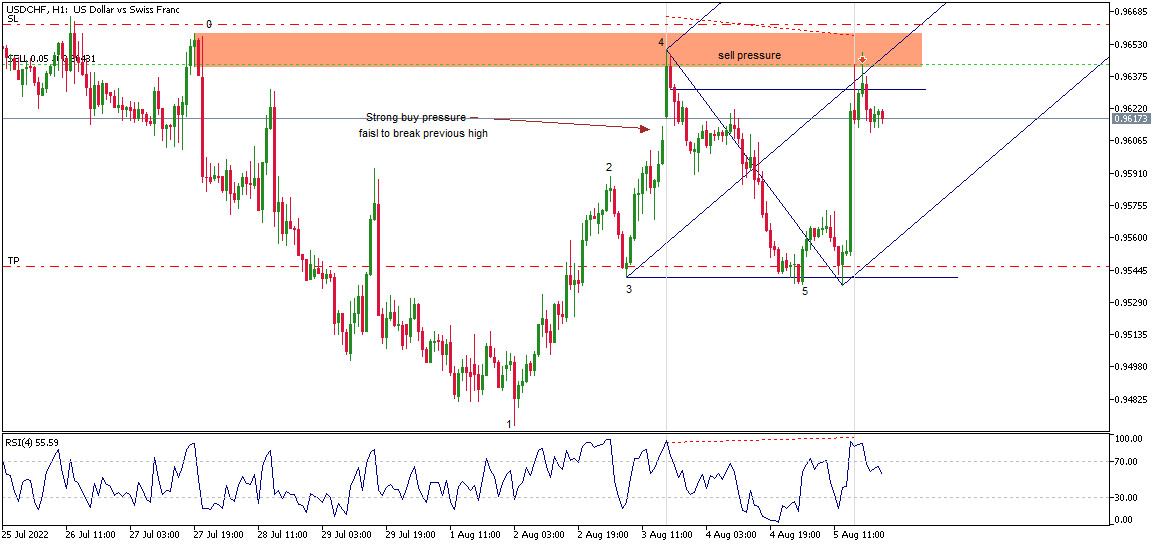

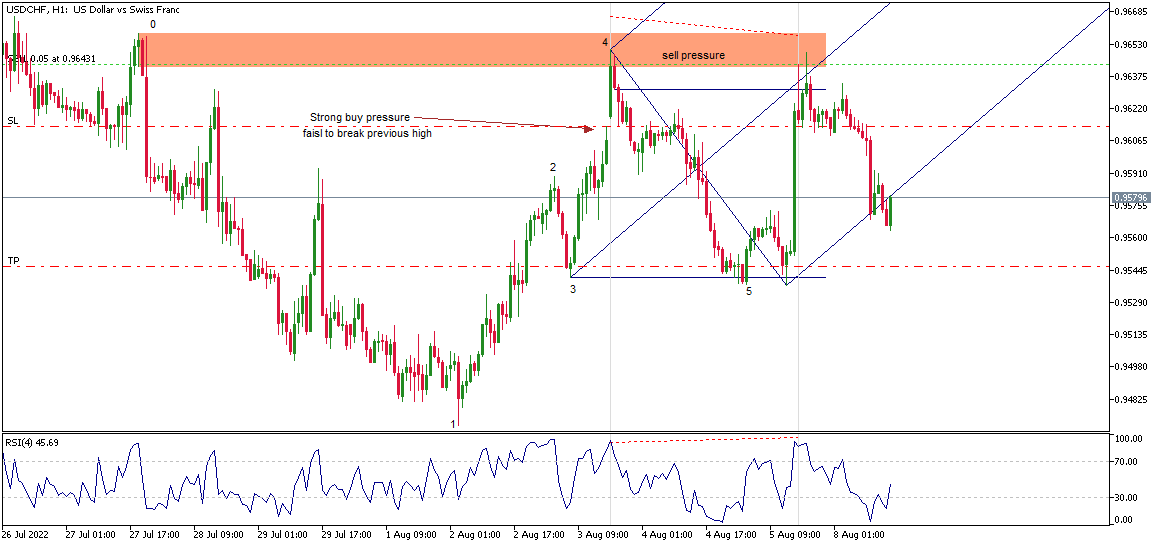

First I numbered my Pivots Highs and Lows, then identified a gap down signaling a sell price exhaustion, then waited for the price to show break of structure by failing to make a new low then making a new high.

After that I used line work to identify a pull back which was my entry point. In terms of money management, I used 1:3 Risk Reward ratio.

The Approach we use to analyze charts is Pure Price Action, a few Indicators and lots of line work. Through many trials and errors, we have proven that most indicators by design are lagging compared to linework such as horizontal S/R sloped S/R, channels etc. This methodology allows us to enter trades at the reversal points thus giving us a good RR ratio and also exit at the market extremes locking in the profit.

NB: What works for us may not work for the other person.

I start my context by identifying highs and lows by numbering them. then I identify major flows and minor flows. The aim is to Identify areas where there is imbalance between buyers and sellers. Next I looked for divergences, works even better if there are exhaustion candles near SR levels.

After I add the pitch to confirm price exhaustion. when i got the confluence of sell pressure zone, Pitchfork, and divergence, i then place a sell limit order whitch was filled exactly at that level.

I then moved my SL to lock-in some profit. This is one of the many trades we have taken, and we can teach you how to trade like a pro.

A win.!

Reach Us

Do you find our journey motivational, or do you notice areas for improvement? We’ re open to all forms of feedback. Additionally, if you’re interested in joining this adventure, please use the contact form on the right to get in touch.

admin@byomarkets.com